capital gains tax canada calculator

You will need information from your records or supporting documents to calculate your capital gains or capital losses for the year. Only 50 of your capital gains are.

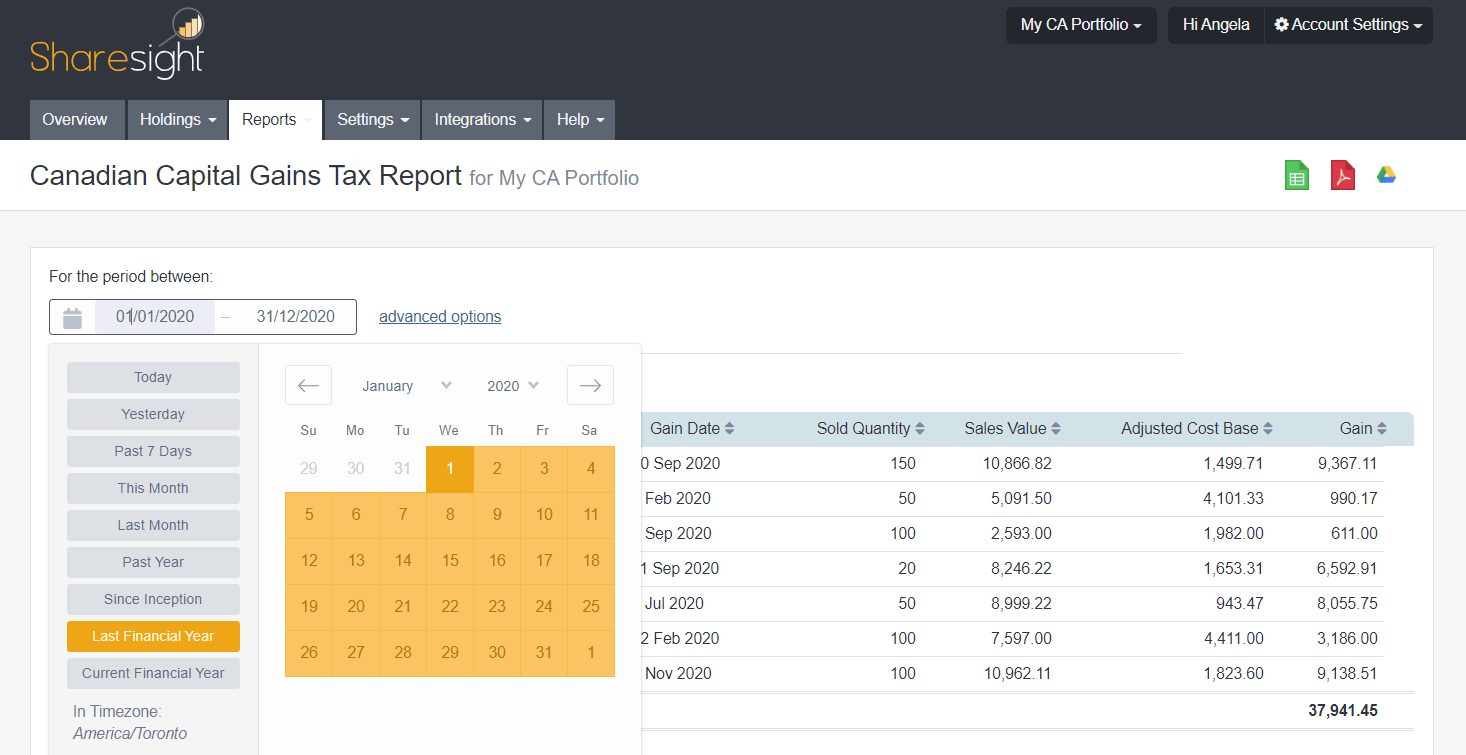

Canadian Capital Gains Tax Report Makes Tax Time Easy

How to calculate capital gains tax.

. We Offer IRAs Rollover IRAs 529s Equity Fixed Income Mutual Funds. Capital Gains Taxes on Property. Proceeds of disposition Adjusted cost base Expenses on disposition Capital gain.

Calculations are estimates based on the tax law as of September 2021. Since its more than your ACB you have a capital gain. The rates of the online calculator apply only if you are a non-resident of Canada who is entitled to benefits under a treaty.

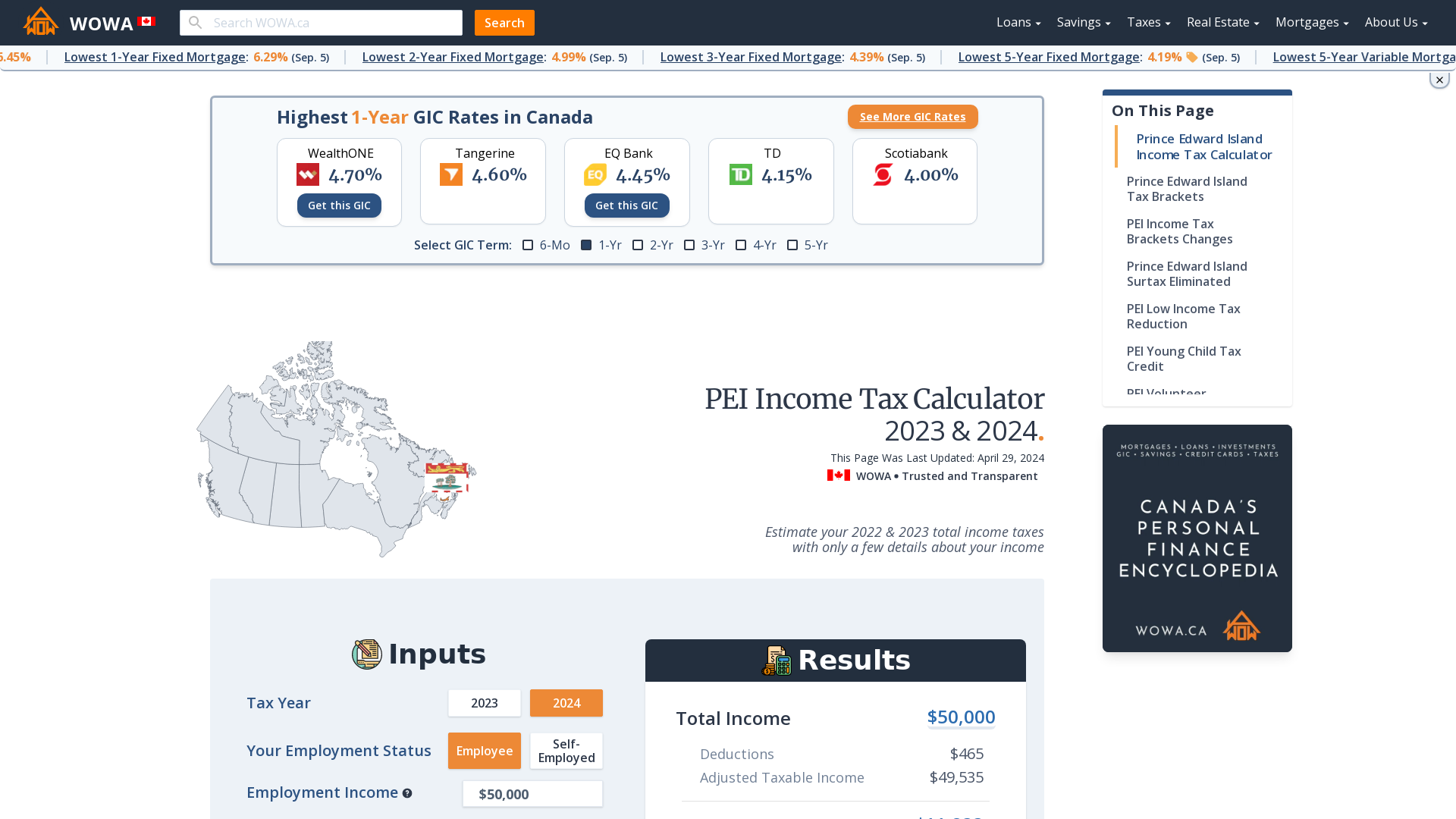

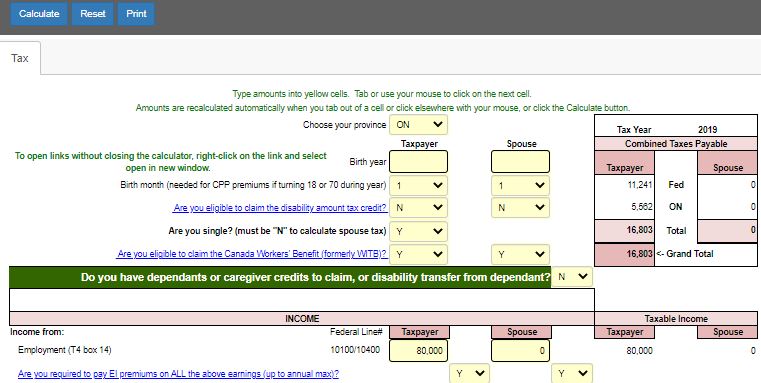

And the tax rate depends on your income. This means that if you earn 1000 in capital gains and you are in the highest tax bracket in say Ontario 5353 you will pay 26760 in Canadian capital gains tax on the 1000 in gains. A good capital gains calculator like ours takes both federal and state taxation into account.

Instead capital gains are taxed at your personal income tax rate. This total is now your new personal income amount and therefore you will be taxed on your capital gains according to the tax bracket that you are in. Capital Gains 2021.

The usual high-income tax suspects California New York Oregon Minnesota New Jersey and Vermont have high taxes on capital gains too. To calculate your capital gain or loss simply subtract your adjusted base cost ABC from your. All capital gains Calculators on iCalculator are updated with the latest Federal and Provincail Tax Rates and Personal Allowances for the 202223 tax year.

This calculator provides calculations based on the information you provide. For instance if you sell a property and make 100000 in profit the capital gains tax rate will only apply to 50000. Long-term capital gains tax profit from the sale of asset or property held a year or longer rates are 0 15 or 20.

The rate you will be charged for this gain will depend. Completing your tax return. Capital Gains Tax Calculator.

Additional income between8345101 to 95812 is taxed at 1050. Use the simple weekly Capital Gains Tax Calculator or complete a comprehensive income tax calculation with the weekly income tax calculator 2022. For more information see Completing Schedule 3.

Use the simple daily Capital Gains Tax Calculator or complete a comprehensive income tax calculation with the daily income tax calculator 2022. Use our capital gains calculator to determine how much tax you might pay on sold assets. The Canadian Monthly Capital Gains Tax Calculator is updated for the 202223 tax year.

The capital gains tax rate on shares is 10 for basic rate taxpayers and 20 for high rate taxpayers. Free income tax calculator to estimate quickly your 2021 and 2022 income taxes for all Canadian provinces. Fidelitys tax calculator estimates your year-end tax balance based on your total income and total deductions.

Your tax bracket is based on your income and filing status. To continue select I accept at the bottom of the page. There is no special capital gains tax in Canada.

It implies that capital gains of up to 12300 are tax-free. Your sale price 3950- your ACB 13002650. You can calculate your Monthly take home pay based of your Monthly Capital Gains Tax Calculator and gross income.

In our example you would have to include 1325 2650 x 50 in your income. How to calculate capital gains tax on the sale of property. This means that half of the profit you earn from selling an asset is taxed and the other half is yours to keep tax-free.

How to Calculate Canada Capital Gains Tax in 5 Steps. You do not need to include these documents with your income tax and benefit return as proof of any sale or purchase of capital property. The amount of tax you need to pay depends on the amount of profit you make when you sell shares.

You can calculate your Weekly take home pay based of your Weekly Capital Gains Tax Calculator and gross income. Heres how short-term capital gains tax rates for 2022 compare by filing status. Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started.

The sale price minus your ACB is the capital gain that youll need to pay tax on. Capital gains tax is calculated as follows. Find out your tax brackets and how much Federal and Provincial taxes you will pay.

In Canada you only pay tax on 50 of any capital gains you realize. On a capital gain of 50000 for instance only half of that amount 25000 is taxable. Our online calculators are designed to make it.

Capital gains tax is a tax on the profit when you dispose of an asset that has increased in value. Do not include any capital gains or losses in your business or property income even if you used the property for your business. High net worth individuals and investors may need to consider the implications of capital gains tax on their personal finances and individual wealth management.

The Canadian Annual Capital Gains Tax Calculator is updated for the 202223 tax year. Our free tool allows you to check your capital gains tax. Because only 12 of the capital gain is taxable Mario completes section 3 of Schedule 3 and reports 1220 as his taxable capital gain at line 12700 on his.

Use the simple monthly Capital Gains Tax Calculator or complete a comprehensive income tax calculation with the monthly income tax calculator 2022. And since 50 of the value of any capital gains is taxable you must then multiply the capital gains by 50 to determine the amount to add to your income tax and benefit return. However the calculator assumes that only the basic personal tax credit as well as the dividend tax credit and Canada.

British Columbia tax rates for 2019 are the following. You can calculate your Annual take home pay based of your Annual Capital Gains Tax Calculator and gross income. However there is a tax-free allowance of 12300 for individuals.

New Hampshire doesnt tax income but does tax dividends and interest. To determine if a treaty applies to you go to Status of Tax Treaty Negotiations. 6500 - 4000 60 2440.

ICalculator is packed with financial calculators which cover everything from income tax calculators to Personal and Business loan calculators. Short-term capital gain tax or profit from the sale of an asset held for less then a year is taxed at the standard income tax rate. Investors pay Canadian capital gains tax on 50 of the capital gain amount.

In Canada 50 of the value of any capital gains is taxable. Adjusted cost base plus outlays and expenses on disposition. That means the tax on any investments you sell on a short-term basis would be determined by your tax bracket.

The Canadian Weekly Capital Gains Tax Calculator is updated for the 202223 tax year. The IRS uses ordinary income tax rates to tax capital gains. How to calculate capital gains tax is to take 50 of the profit add it to your income and calculate the marginal tax rate for that income this will vary by province.

Mario calculates his capital gain as follows. Use the simple annual Capital Gains Tax Calculator or complete a comprehensive income tax calculation with the annual income tax calculator 2022. Additional income between 4172501 and 83451 is taxed at 770.

The Canadian Daily Capital Gains Tax Calculator is updated for the 202223 tax year. Use Schedule 3 Capital gains or losses to calculate and report all your capital gains and losses. You can calculate your Daily take home pay based of your Daily Capital Gains Tax Calculator and gross income.

Pei Income Tax Calculator Wowa Ca

Capital Gains Tax Calculator For Relative Value Investing

Capital Gains Tax Calculator 2022 Casaplorer

Learn 04 Money Under Your Mattress Vs Savings Vs Investing Investing Savings And Investment Investing 101

Ontario Sales Tax Hst Calculator 2022 Wowa Ca

Marginal Tax Rates How To Calculate Ontario Income Tax Kalfa Law

Excel Formula Income Tax Bracket Calculation Exceljet

Canada Annual Capital Gains Tax Calculator 2022 23 Salary

A Capital Gains And Tax Calculator For Your Stock Crypto Investments R Personalfinancecanada

Capital Gains Tax Calculator For Relative Value Investing

Corporate Class Swap Etf Tax Calculator Physician Finance Canada

If You Purchased A New House From A Builder Within The Past 24 Months You Might Be Qualified For The Federal And Provincial New Tax Consulting Tax Income Tax

Canada Capital Gains Tax Calculator 2021 Nesto Ca

One Pager With Steps Inside Of Steps And Real Life Animation To Accompany It Investing On Autopilot Wealthsimple Investing Filing Taxes Smart Investing

Complete Guide To Canadian Marginal Tax Rates In 2020 Kalfa Law

Taxtips Ca 2019 Canadian Income Tax And Rrsp Savings Calculator